- Illyrian News

- Posts

- [Week 9]: Top Stocks To Watch This Week

[Week 9]: Top Stocks To Watch This Week

Good evening. The S&P 500 ended the week down -1.0%. Here are the top stocks to watch this week, and what’s moving the markets.

👋 Also welcome to the 256 new members who have joined since last Sunday! If you haven’t subscribed yet, join other traders & financial enthusiasts who have decided to get smarter with Illyrian News.

Top Stocks & Setups To Watch This Week

• $RBLX

Break below 61.80 🎯 59.14 & 56.26

• $TSLA

Break above 299.75 🎯 321.22 & 336

• $MRK

Break above 93.06 🎯 95.15 & 97.39

• $NFLX

Break above 985 🎯 1016.35 & 1045.99

• $ADBE

Break above 448.42 🎯 458.82 & 465.70

• $MSFT

Break above 399.38 🎯 409.98 & 419.31

KV’s S&P 500 Levels

Weekly Market Recap

Market Pullbacks

The S&P 500 briefly erased its year-to-date gains, with the Magnificent 7 stocks shifting from leaders to laggards. Growth concerns have emerged as economic indicators, including retail sales and jobless claims, show signs of slowing. Policy uncertainty, particularly tariffs, has added to market jitters. Meanwhile, big tech struggles, with NVIDIA’s earnings falling short of expectations, highlighting high valuations and investor caution.

Economic Resilience

Despite near-term volatility, the economy remains resilient, with GDP growth projected at 2.3% in 2025. The labor market continues to support consumer spending, with wage growth outpacing inflation. AI investment remains strong, driving long-term growth prospects, while corporate profits are accelerating, with S&P 500 earnings up 18% in Q4. Investor sentiment has reset, reducing market froth and potentially setting up stronger returns ahead.

Portfolio Re-Positioning

While a correction is possible, market fundamentals remain intact, with no signs of economic decline, falling corporate profits, or Fed rate hikes. Trade policy and tariffs may keep volatility elevated, making diversification and rebalancing crucial. Investors should focus on cyclical, value, and international stocks while taking advantage of dollar-cost averaging. With equities poised for moderate gains, market leadership continues to evolve.

Coming Up…

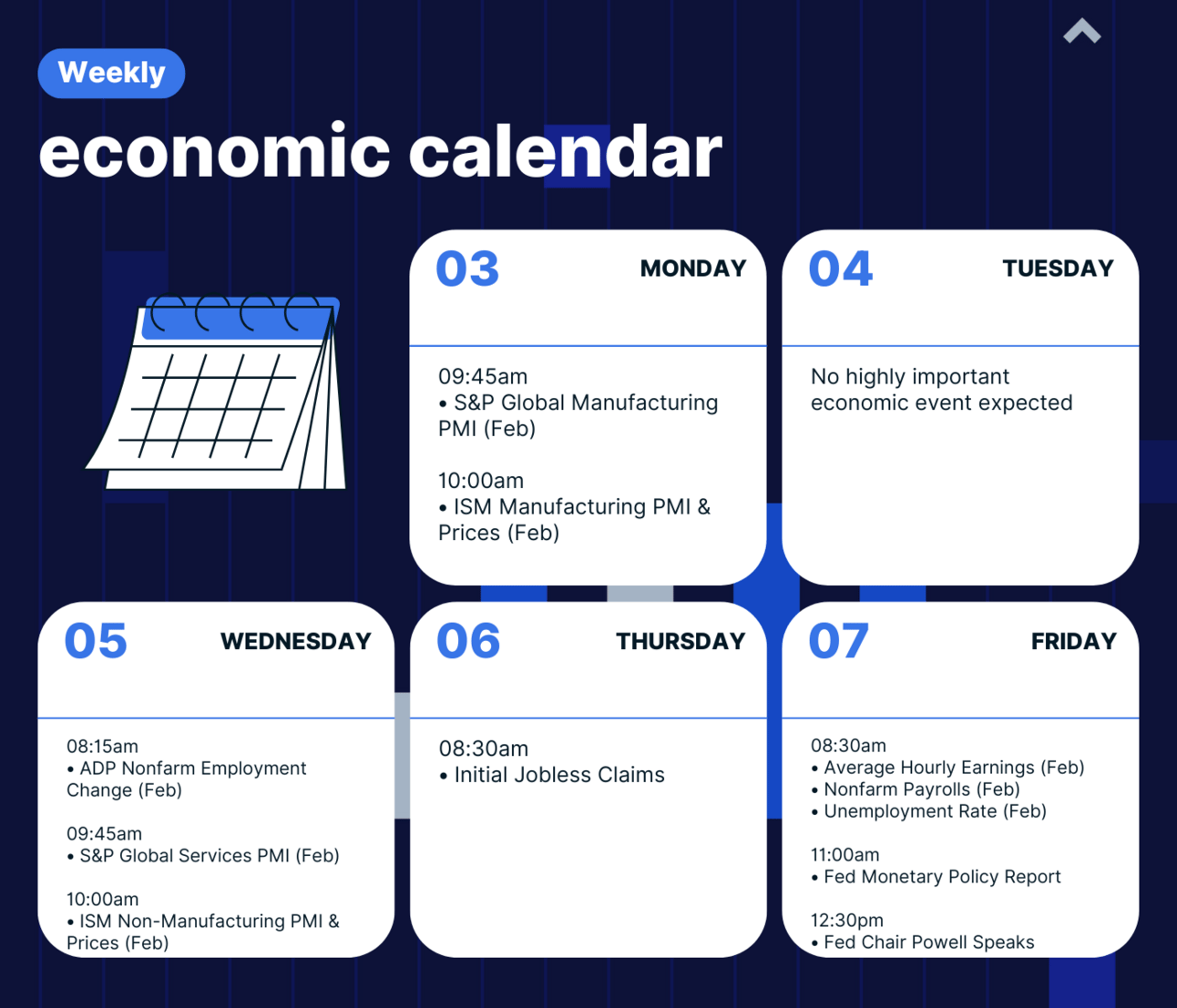

Important economic releases this week include the ISM Manufacturing PMI and nonfarm payrolls report for February. On the earnings front, AVGO, CRW, TGT, JD, COST, and PLUG are expected to report this week.

Key Headlines We’ve Been Reading

This is what’s caught our eye over the past 7 days.

• S&P 500 rout poses fresh test for Wall Street’s dip-buying habit.

• EU pushes back hard against Trump tariff threats and his caustic comments that bloc is out to get US.

• Gold stocks glitter as worries around inflation, tariffs flare.

• Buffett’s bet sparks surge in Japan trading house shares.

• Musk’s SpaceX to integrate Starlink terminals in U.S. FAA’s airspace network.

Trading Quote Of The Week

Do more of what works and less of what doesn’t.

That was it for this week!

Stay safe,

KV 👋

Week #9 | March 2, 2025

Like Illyrian News? Share it with your friends, family, and colleagues who need to stay on top of the market and earn awesome rewards!

Your referral count: {{rp_num_referrals}}, only {{rp_num_referrals_until_next_milestone}} referral away from winning {{rp_next_milestone_name}}.

Or copy & paste your referral link to others:

{{rp_refer_url}}

Like getting this newsletter, but feel like you could learn more from KV & the team? Find out some of the frameworks and strategies that KV’s private mentorship clients are using to hit their trading goals. Book a free discovery call here.

Want to sponsor this newsletter? Reply to this email with the word PARTNER and we’ll get back to you for further details.

Reply